How to do Futures Trading on FameEX

In this comprehensive guide, we will walk you through the fundamentals of futures trading on FameEX, covering key concepts, essential terminology, and step-by-step instructions to help both beginners and experienced traders navigate this exciting market.

What are Perpetual Futures Contracts?

A futures contract is a legally binding agreement between two parties to buy or sell an asset at a predetermined price and date in the future. These assets can vary from commodities like gold or oil to financial instruments such as cryptocurrencies or stocks. This type of contract serves as a versatile tool for both hedging against potential losses and securing profits.

Perpetual futures contracts, a subtype of derivatives, enable traders to speculate on the future price of an underlying asset without actually owning it. Unlike regular futures contracts with set expiration dates, perpetual futures contracts do not expire. Traders can maintain their positions for as long as they desire, allowing them to capitalize on long-term market trends and potentially earn substantial profits. Additionally, perpetual futures contracts often feature unique elements like funding rates, which help align their price with the underlying asset.

One distinctive aspect of perpetual futures is the absence of settlement periods. Traders can keep a position open for as long as they have sufficient margin, without being bound by any contract expiry time. For instance, if you purchase a BTC/USDT perpetual contract at $60,000 there is no obligation to close the trade by a specific date. You have the flexibility to secure your profit or cut losses at your discretion. It’s worth noting that trading perpetual futures is not allowed in the U.S., although it constitutes a substantial portion of global cryptocurrency trading.

While perpetual futures contracts offer a valuable tool for gaining exposure to cryptocurrency markets, it’s essential to acknowledge the associated risks and exercise caution when engaging in such trading activities.

How to Activate FameEX Futures?

Activate Trading on FameEX Futures (Web)

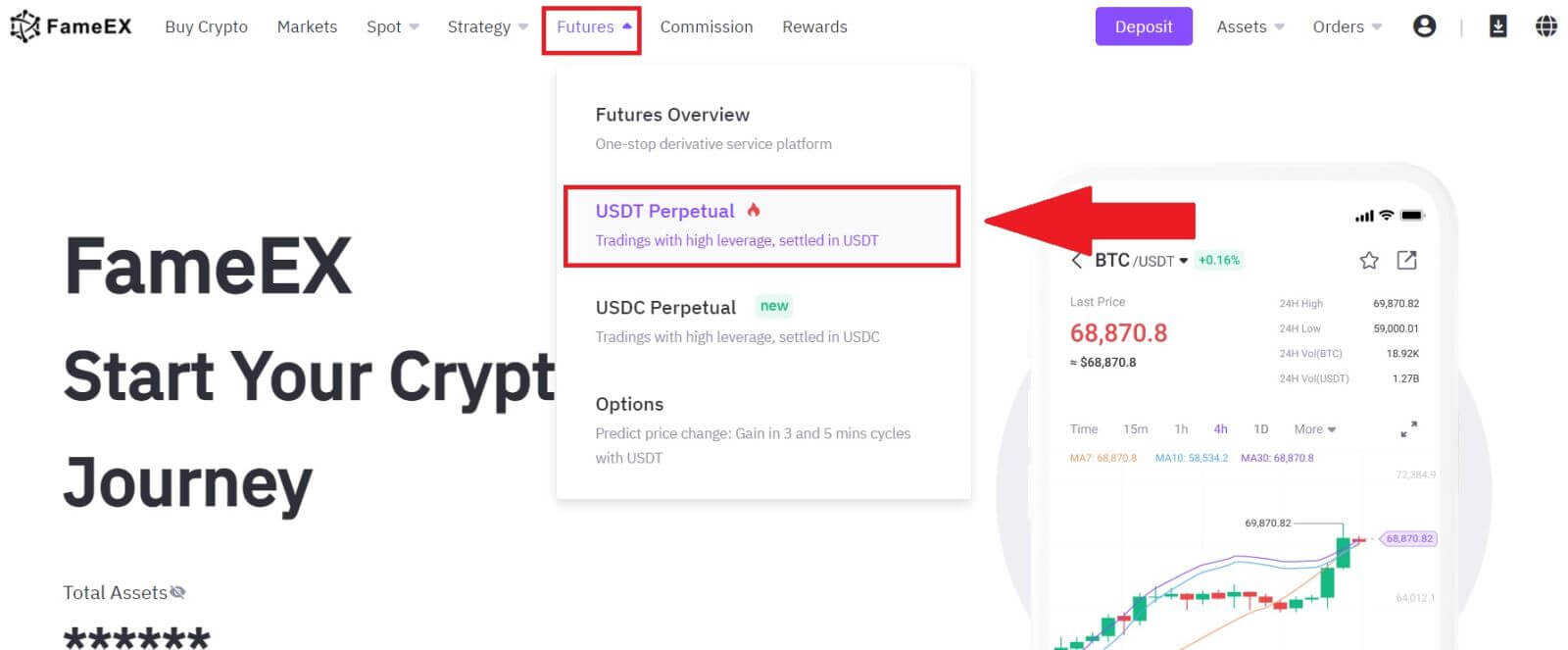

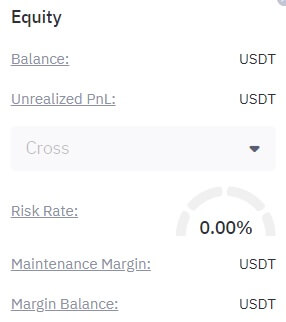

1. Go to the FameEX Website, click [Futures], and select [USDT Perpetual].

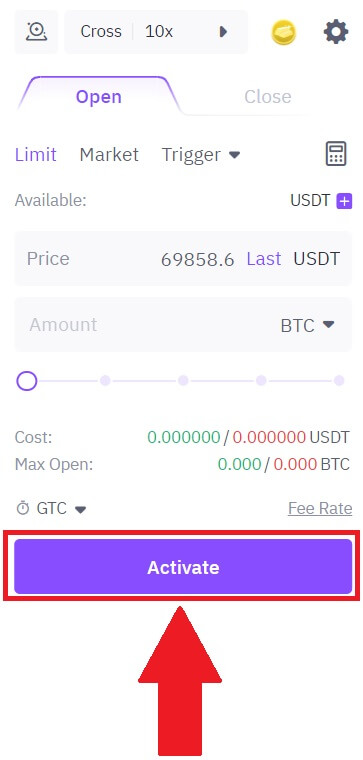

2. If you have not yet activated Futures trading, click [Activate] on the right hand side on the futures trading page

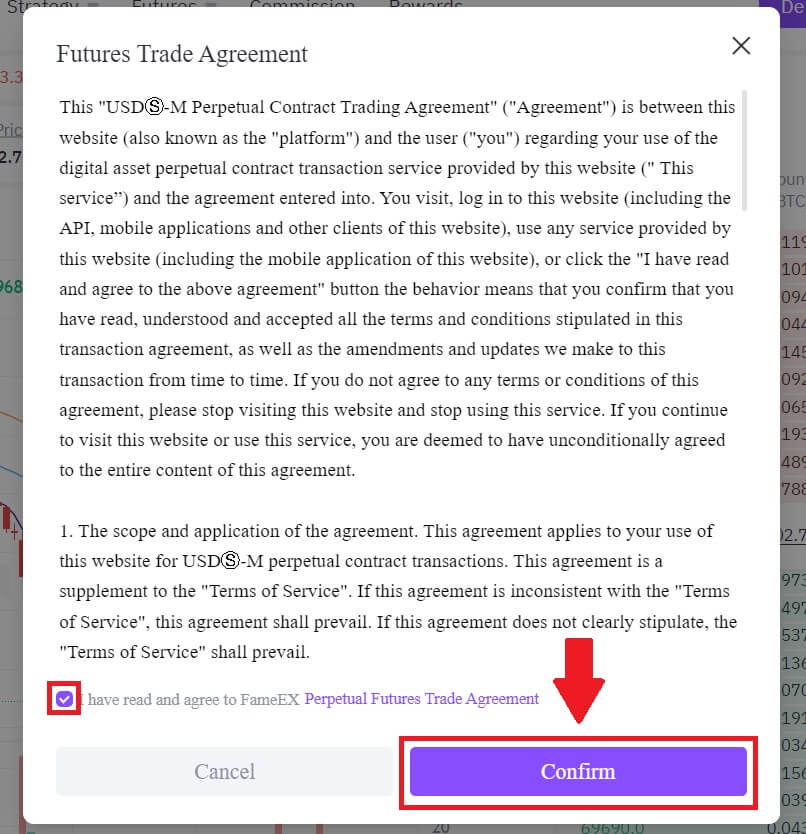

3. Carefully read the FameEX Futures Trade Agreement, check to agree, and click [Confirm].

After that, you have successfully activated trading on FameEX Futures.

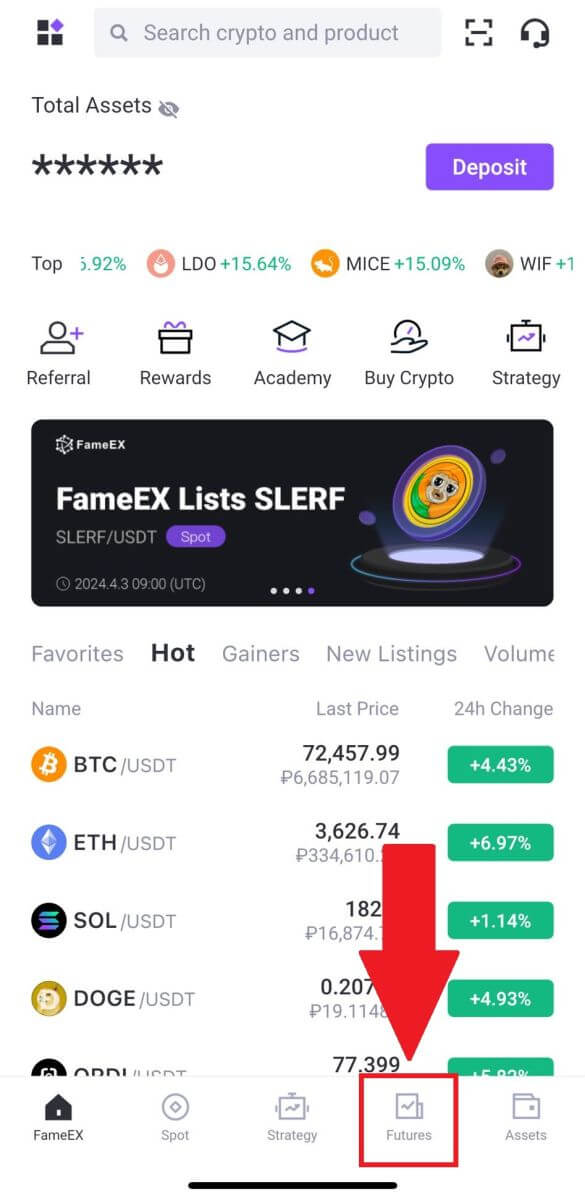

Activate Trading on FameEX Futures (App)

1. Open your FameEX App, on the first page, tap on [Futures].

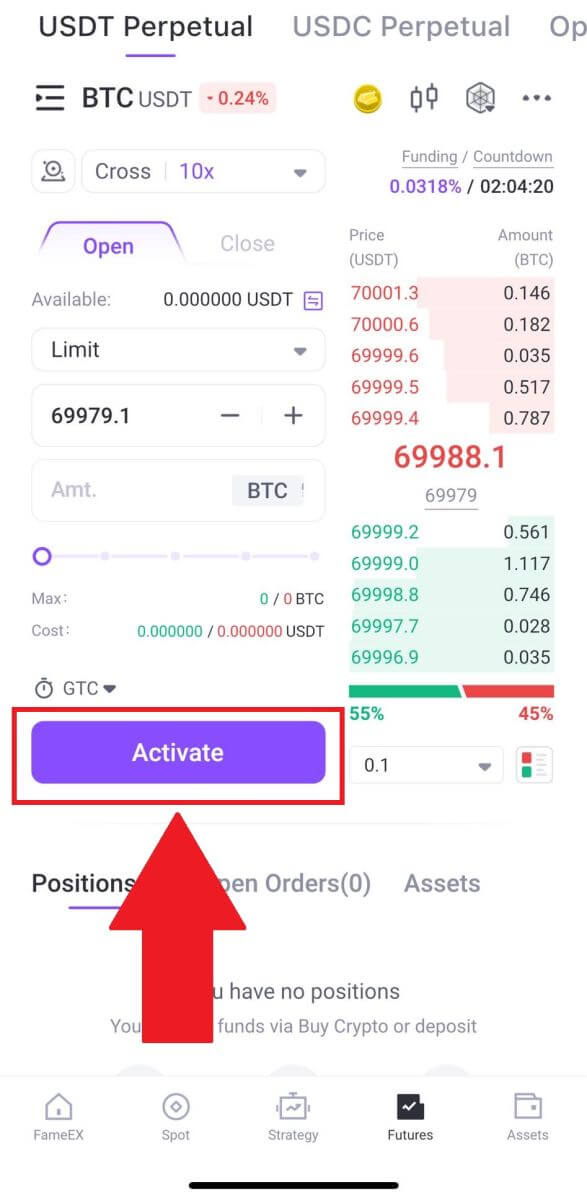

2. If you have not yet activated Futures trading, click [Activate].

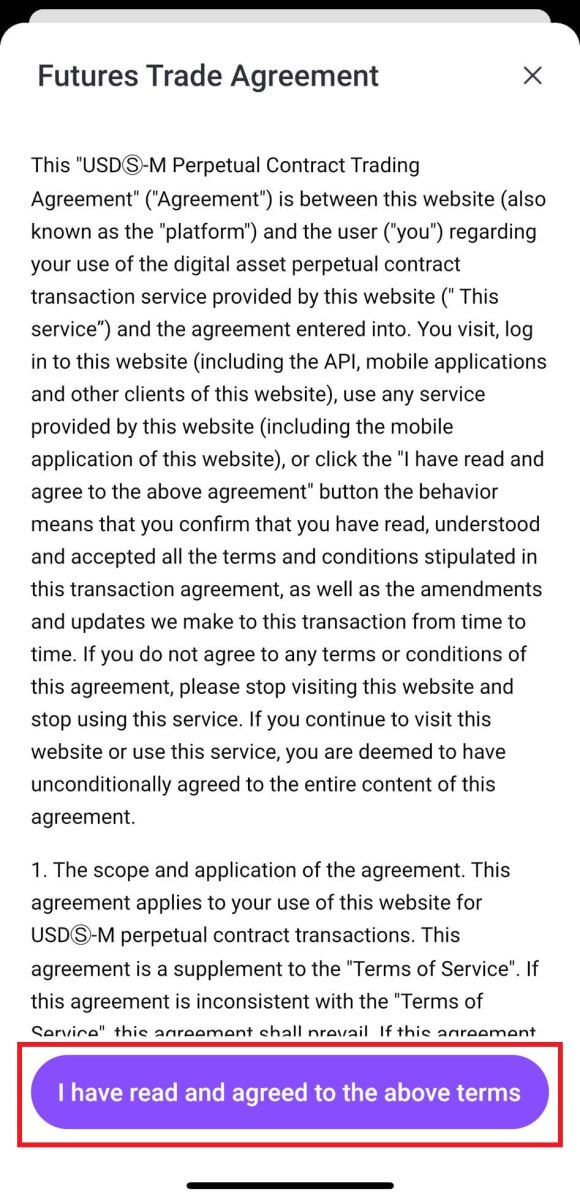

3. Read FameEX Perpetual Contract Trading Agreement carefully, and tap [I have read and agreed to the above terms].

After that, you have successfully activated trading on FameEX Futures.

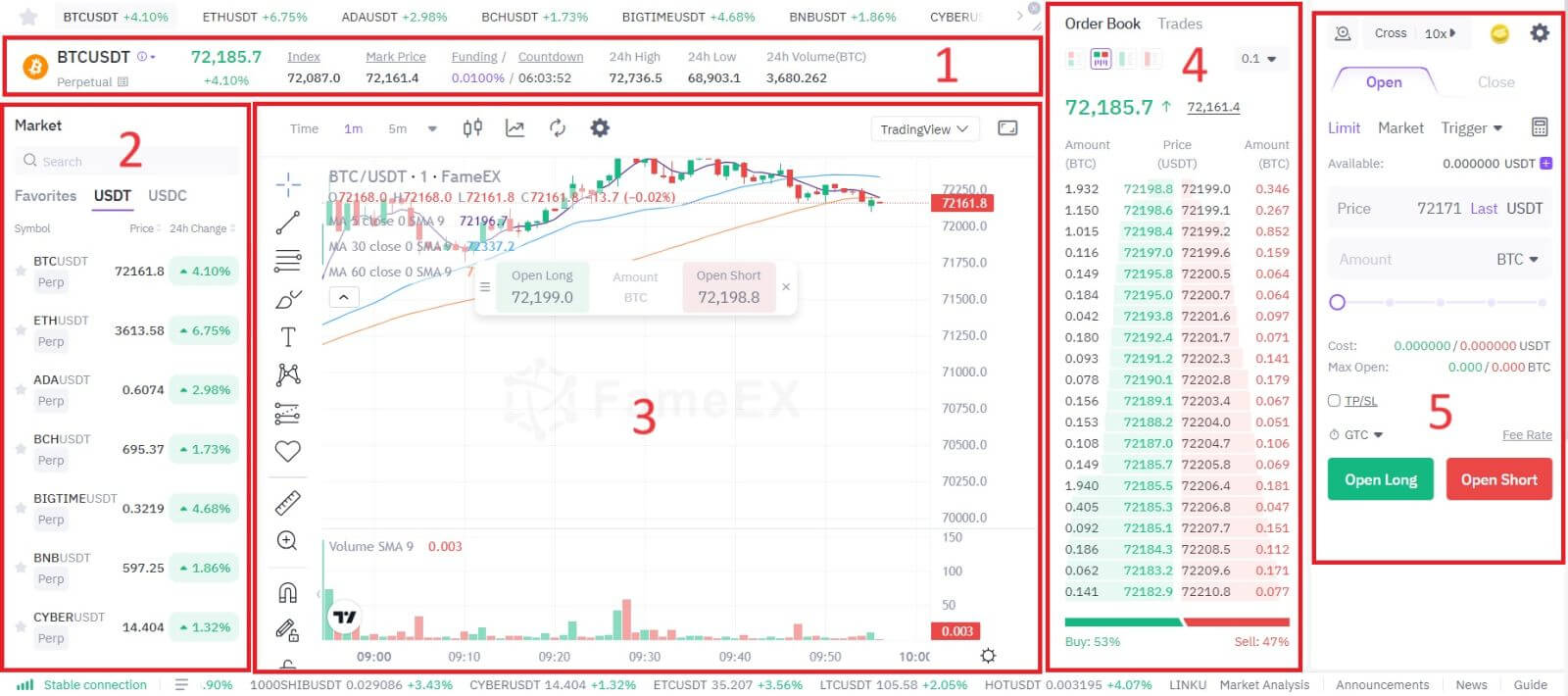

Explanation of Terminology on the Futures Trading Page on FameEX

For beginners, futures trading can be more complex than spot trading, as it involves a greater number of professional terms. To help new users understand and master futures trading effectively, this article aims to explain the meanings of these terms as they appear on the FameEX futures trading page.

We will introduce these terms in order of appearance, starting from left to right.

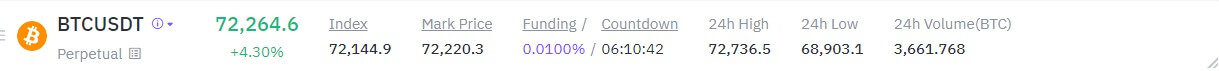

1. Top navigation menu: In this navigational section, you can have quick access to various functions, including: Index, Mark Price, Funding/Countdown, 24h High, 24h Low, 24h Volume .

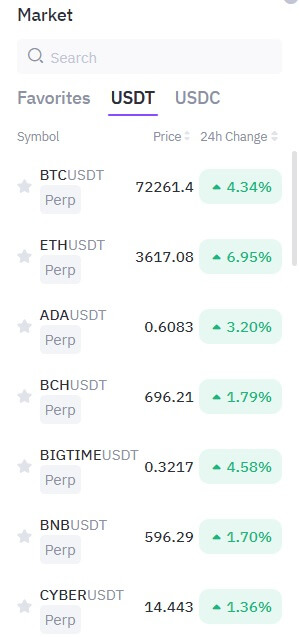

2. Futures Market: Here, you can directly search for the contract you want to trade in the list. What’s more, you can customize your trading page layout. By switching to the old version of the layout, you can view your asset balance in the upper left corner.

3. Chart Sector: The original chart is more suitable for beginners, while the TradingView chart suits professional traders. The TradingView chart allows indicator customization and supports full-screen for a clearer indication of price movements.

4. Order Book: A window to observe market trends during the trading process. In the order book area, you can observe each trade, the proportion of buyers and sellers, and more.

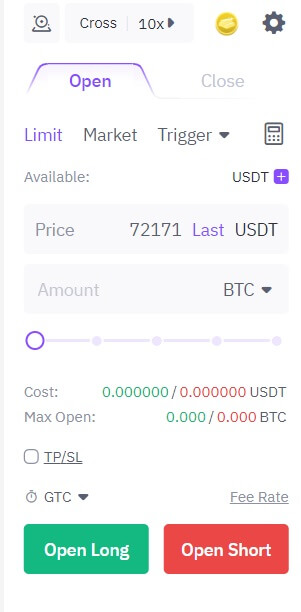

5. Order Sector: Here you can set various order parameters, including price, amount, trading unit, leverage, etc., after selecting the contract you want to trade. Once you are comfortable with your order parameter settings, click the "Open Long/Short" button to send your order to the market.

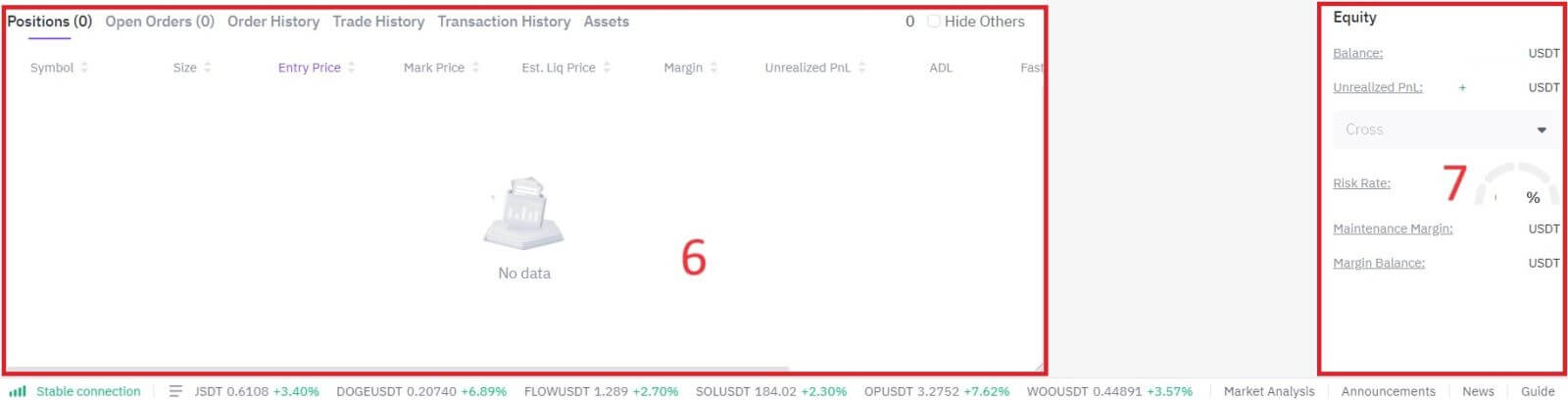

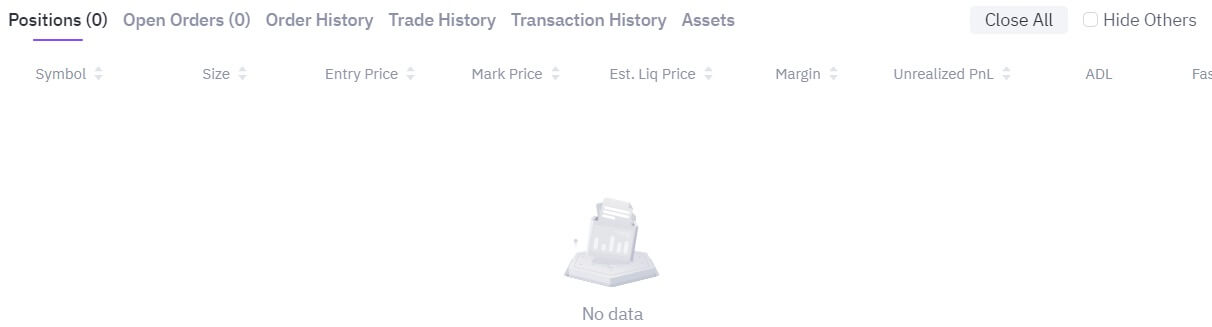

6. Position Sector: After the orders are placed, you can check out the detailed transaction status under the various tabs of Open Orders, Order History, Position History, Assets, etc.

7. Equity Sector: Here you can have an overview of your asset details.

How to Trade USDT Perpetual Futures on FameEX

Trade USDT Perpetual Futures on FameEX (Web)

1. Go to the FameEX Website, click [Futures], and select [USDT Perpetual].

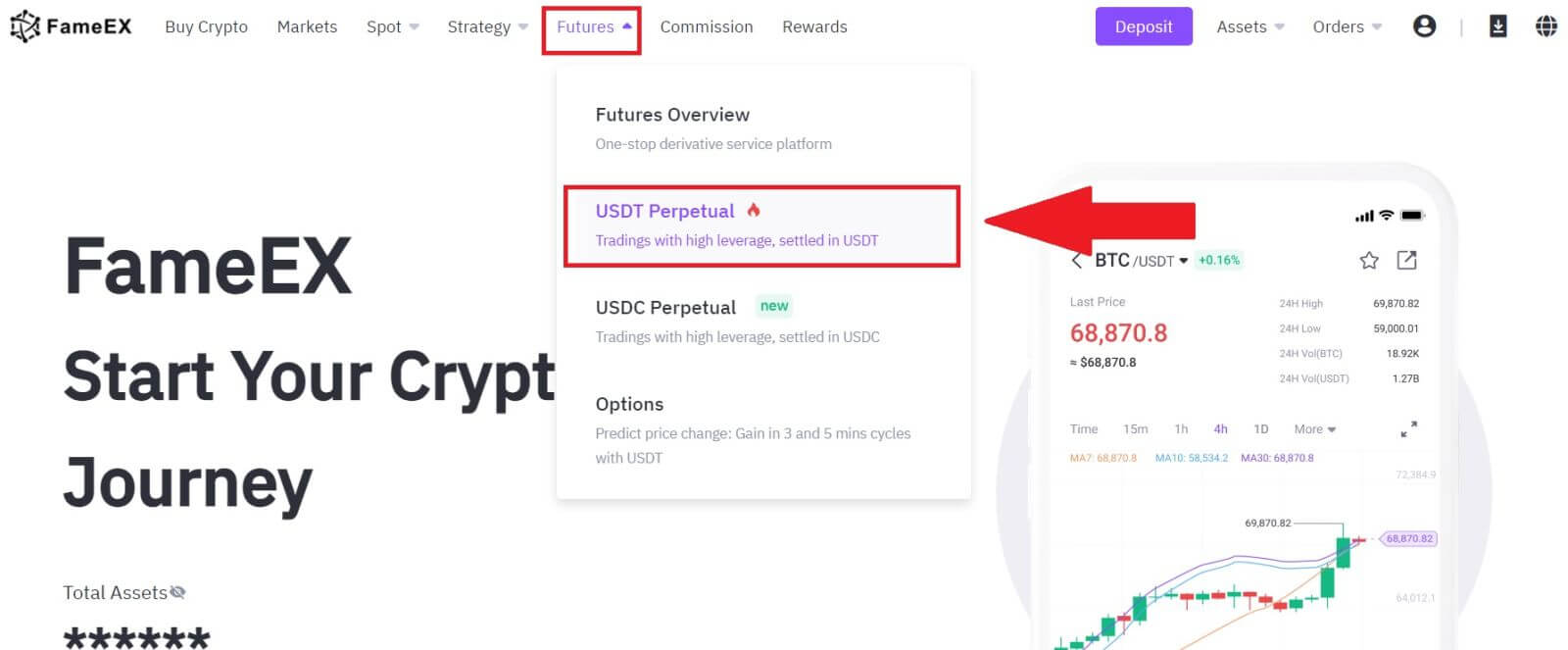

2. On the left-hand side, select BTC/USDT as an example from the list of futures.

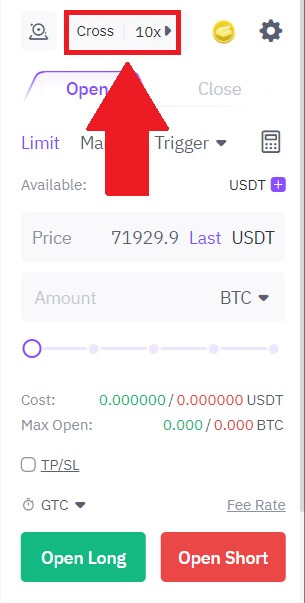

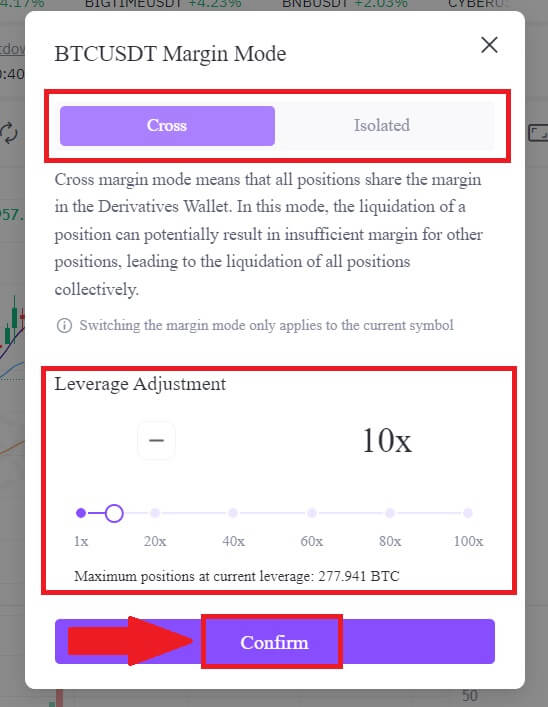

3. Click on the following part. Here, you can click on Isolated or Cross to choose your [Margin Mode], and you can adjust the leverage multiplier by clicking on the number. After that, click [Confirm] to save your change.

The platform supports traders with different margin preferences by offering different margin modes.

- The Cross Margin: All cross positions under the same margin asset share the same asset cross margin balance. In the event of liquidation, your assets full margin balance along with any remaining open positions under the asset may be forfeited.

- The Isolated Margin: Manage your risk on individual positions by restricting the amount of margin allocated to each. If the margin ratio of a position reached 100%, the position will be liquidated. Margin can be added or removed to positions using this mode.

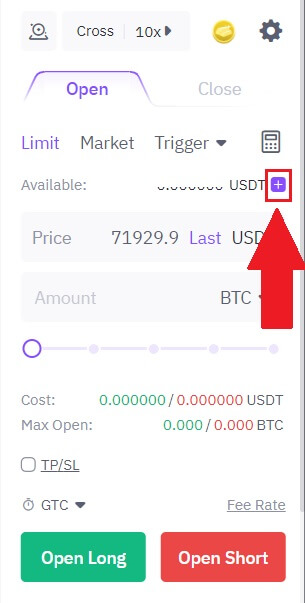

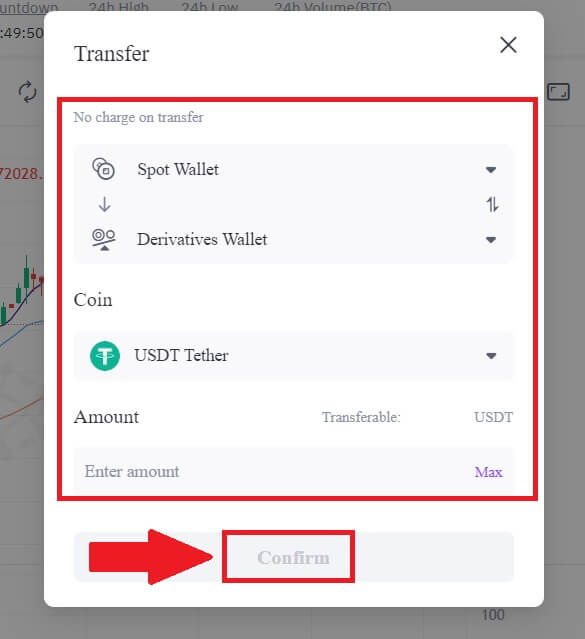

4. To initiate a fund transfer from the spot account to the futures account, click on the [+] icon to access the transfer menu.

Once in the transfer menu, enter the desired amount you wish to transfer, and click on [Confirm].

5. To open a position, users have three options: Limit Order, Market Order, and Trigger Order. Follow these steps:

Limit Order:

- Set your preferred buying or selling price.

- The order will only be executed when the market price reaches the specified level.

- If the market price doesn’t reach the set price, the limit order remains in the order book, awaiting execution.

- This option involves a transaction without specifying a buying or selling price.

- The system executes the transaction based on the latest market price when the order is placed.

- Users only need to input the desired order amount.

Trigger Order:

- Set a trigger price, order price, and order quantity.

- The order will only be placed as a limit order with the predetermined price and quantity when the latest market price hits the trigger price.

- This type of order provides users with more control over their trades and helps automate the process based on market conditions.

Then, click [Open Long] to initiate a long position, or [Open Short] for a short position.

7. After placing your order, view it under [Open Orders] at the bottom of the page. You can cancel orders before they’re filled.

Trade USDT Perpetual Futures on FameEX (App)

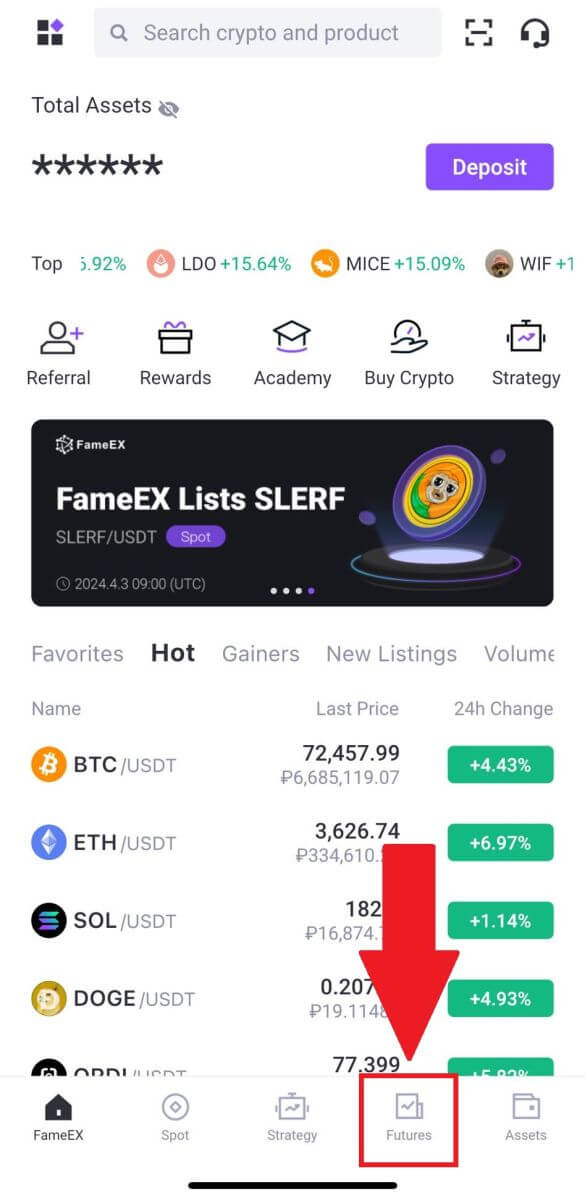

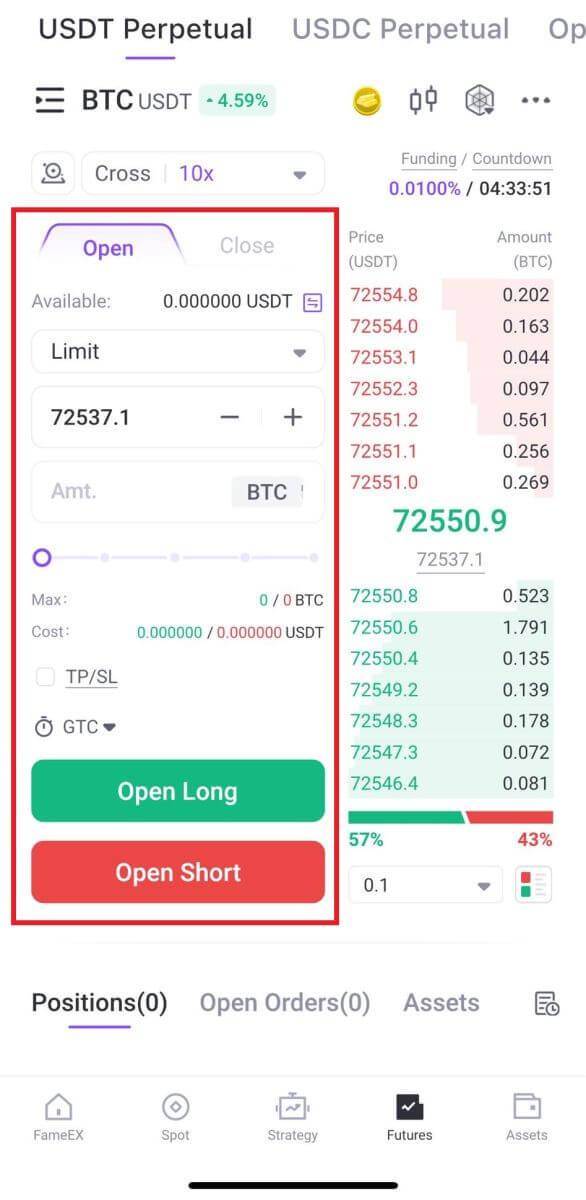

1. Open your FameEX App, on the first page, tap on [Futures].

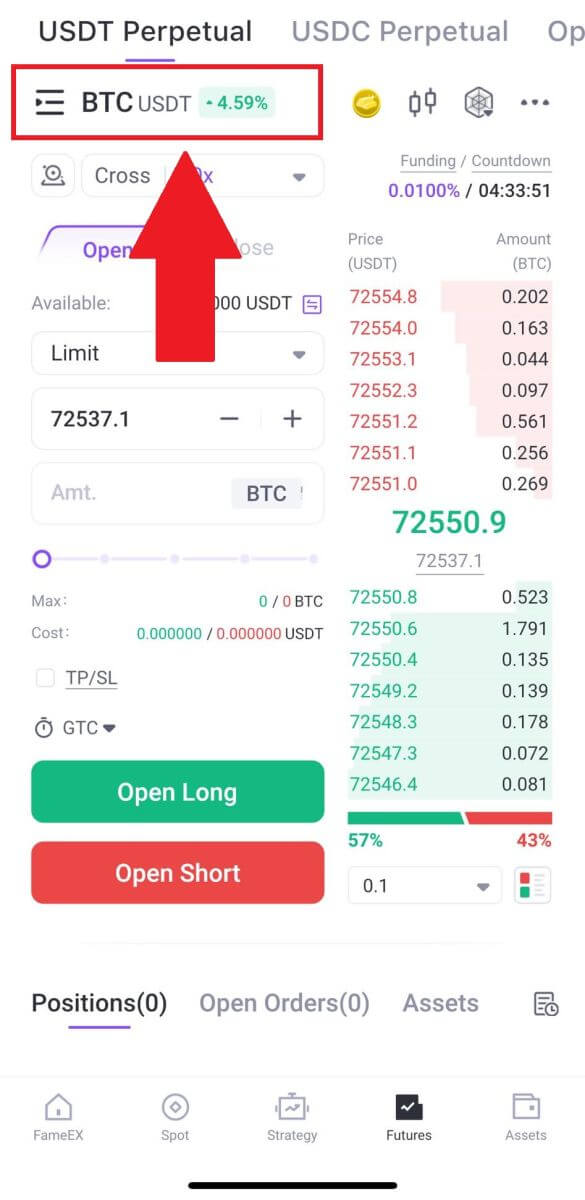

2. To switch between different trading pairs, tap on [BTCUSDT], located at the top left. You can then utilize the search bar for a specific pair or directly select from the listed options to find the desired futures for trading.

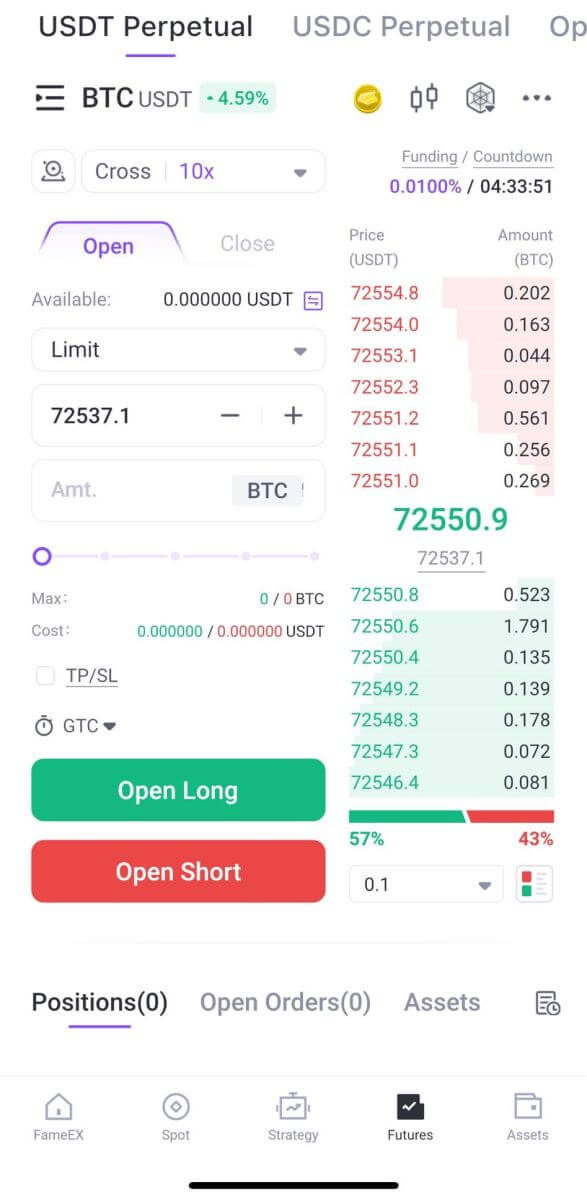

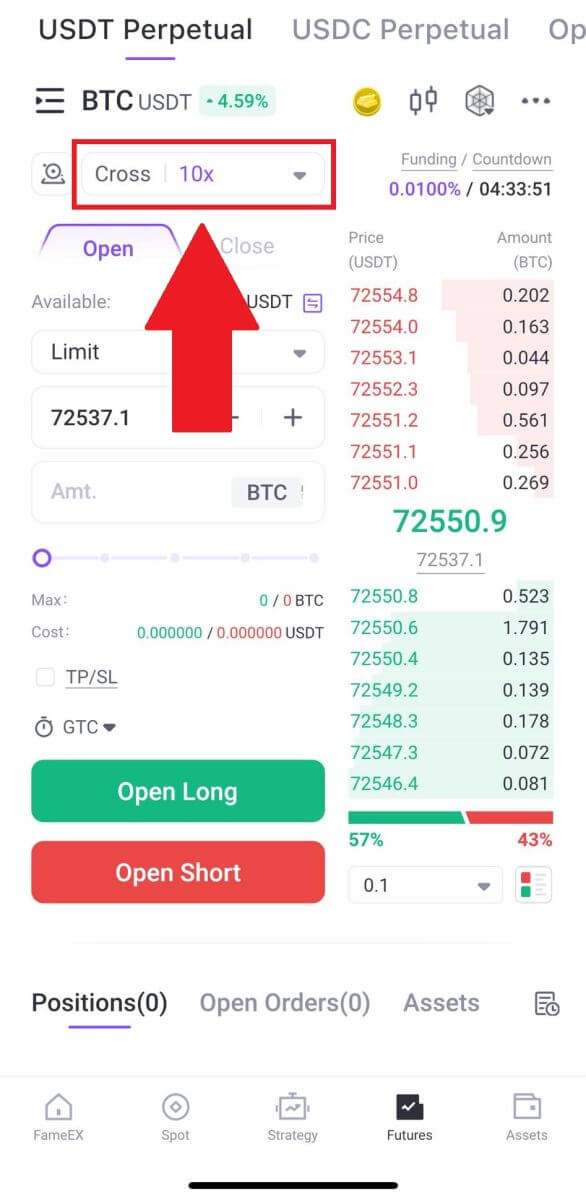

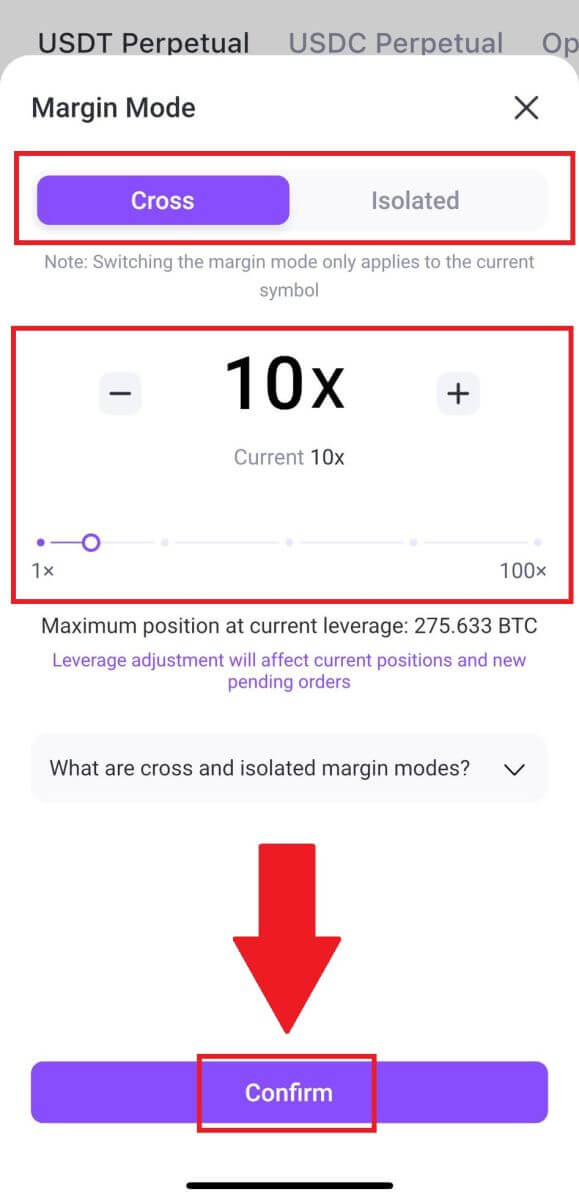

3. Click on the following part. Here, you can click on Isolated or Cross to choose your [Margin Mode], and you can adjust the leverage multiplier by clicking on the number. After that, click [Confirm] to save your change.

The platform supports traders with different margin preferences by offering different margin modes.

- The Cross Margin: All cross positions under the same margin asset share the same asset cross margin balance. In the event of liquidation, your assets full margin balance along with any remaining open positions under the asset may be forfeited.

- The Isolated Margin: Manage your risk on individual positions by restricting the amount of margin allocated to each. If the margin ratio of a position reached 100%, the position will be liquidated. Margin can be added or removed to positions using this mode.

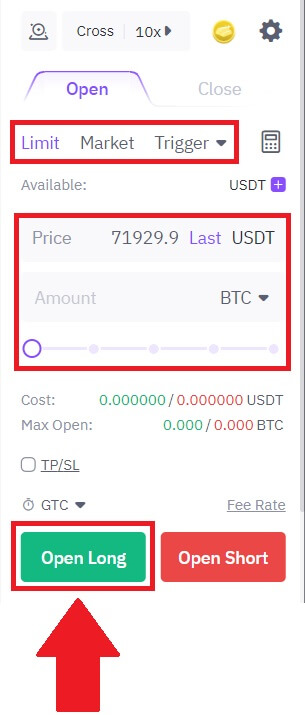

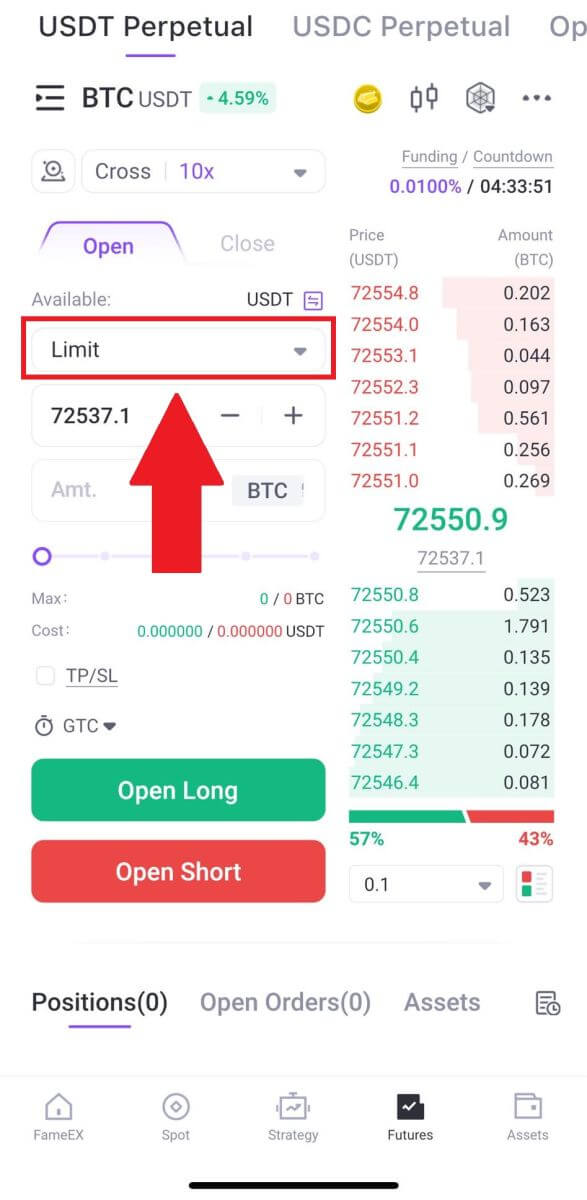

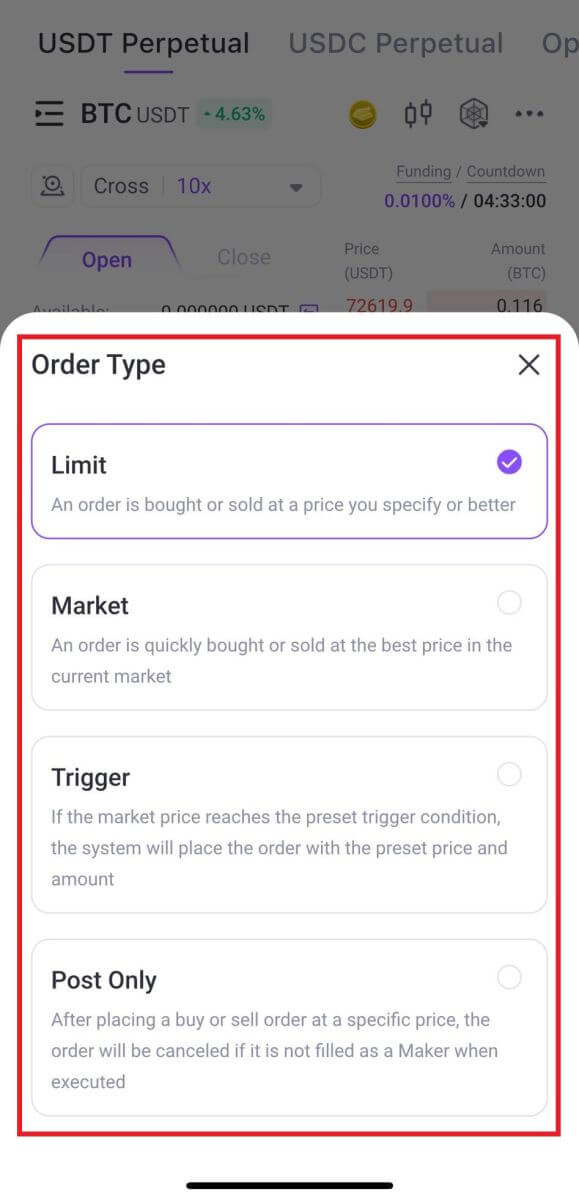

4. Choose your order type by tapping on the following.

5. On the left side of the screen, place your order. For a limit order, enter the price and amount; for a market order, input only the amount. Tap [Open Long] to initiate a long position, or [Open Short] for a short position.

6. Once the order is placed, if it isn’t filled immediately, it will appear in [Open Orders].

Futures Order Type Introduction

FameEX supports the following order types:

1. Limit Order

A limit order allows a user to set the order amount and specify the maximum buy price or minimum sell price they are willing to accept. This order type will only be executed when opposing orders in the market match the specified price range.

Note:

-

The buy price of a limit order cannot exceed 110% of the last price, and the sell price cannot be less than 90% of the last price.

-

The actual execution price of a limit buy order will not surpass the order price. Similarly, the actual execution price of a limit sell order will not be lower than the order price.

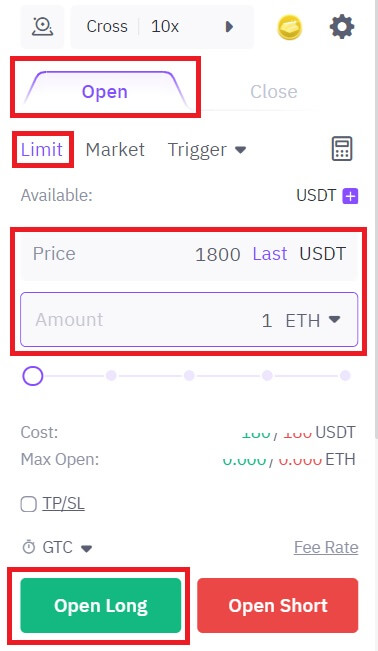

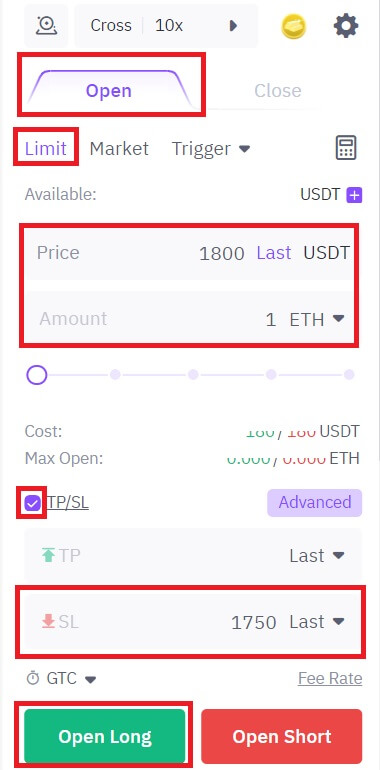

For instance, if you’re trading in the ETHUSDT perpetual futures zone under hedge mode, and the latest price of ETH is 1900 USDT, you aim to open a long position of 1 ETH when the market price drops to 1800 USDT.

To place a limit order:

Select [Limit] on the trading page, enter the order price and the order amount, and click [Open Long].

2. Market Order:

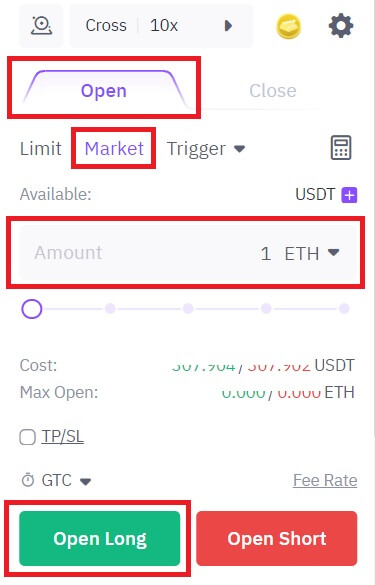

A market order is used to instantly buy or sell positions at the current market price, ensuring quick execution without specifying a particular price.

For example, if you’re trading in the ETHUSDT perpetual futures zone under hedge mode, and the latest price of ETH is 1900 USDT, and you want to open a long position of 1 ETH at the current market price of 1900 USDT as soon as possible, you would place a market order

Select [Market] on the trading page, enter the order amount of 1, and click [Open Long].

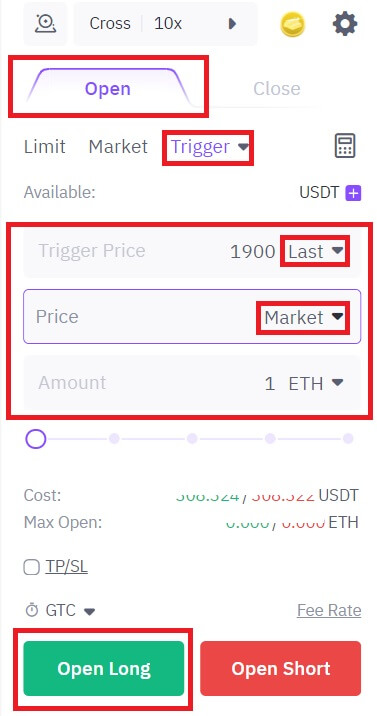

3. Trigger Order

A trigger order is executed when the market price meets the predefined trigger condition, initiating an order with the specified order price and amount.

Key Terms:

Trigger Price: This denotes the predetermined condition at which the order will be triggered. Users can choose the index, last, or mark price as the trigger price.

Order Price: Upon trigger activation, the system will place the order at the designated order price. Users can opt for either limit or market price as the order price.

Order Amount: After the trigger order is activated, the system will execute the order with the specified amount. Users can switch between the base and quote coins for the order amount.

Note: Assets remain unfrozen until the trigger order is activated. If there are insufficient assets upon triggering, the order will be canceled.

For example, if you’re trading in the ETHUSDT perpetual futures zone under hedge mode, and the latest price of ETH is 1850 USDT, and you aim to open a long position of 1 ETH when the market price surges to around 1900 USDT, you would place a trigger order.

Select [Trigger] on the trading page, enter a trigger condition and an order price (market or limit price) into Trigger Price and Price input boxes respectively, and set up the order amount in the Amount input box. Then, click [Open Long].

4. Post Only Order

Post Only orders are designed to be added to the order book without immediate execution in the market. When a Post Only order matches with an existing order, it will be canceled, ensuring that the user always acts as a Maker.

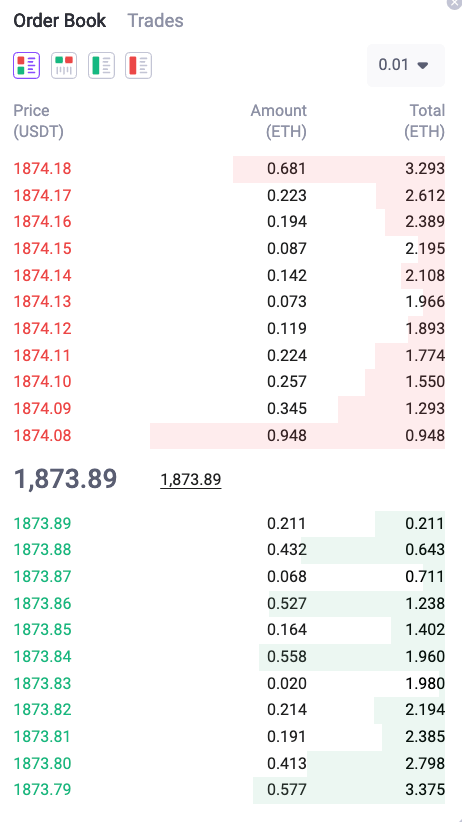

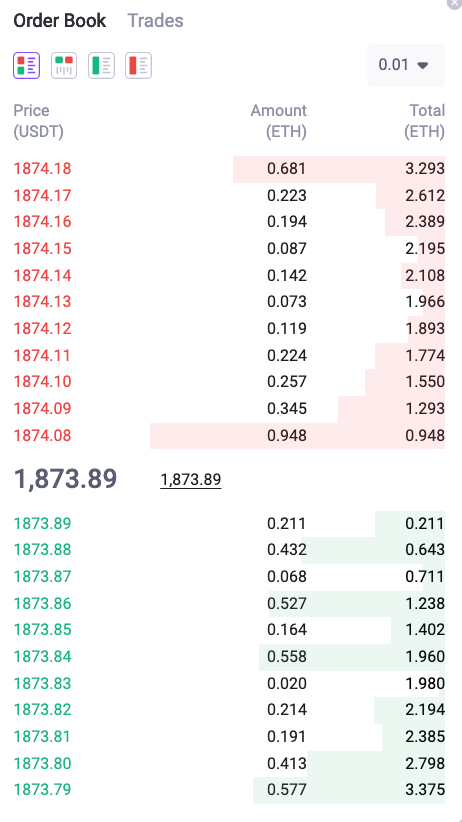

For instance, if you’re trading in the ETHUSDT perpetual futures zone under hedge mode, the current order book will appear as follows:

To benefit from the maker fee rate, users can choose "Post Only" when initiating an order. For instance, if you’re buying 0.1 ETH at a price of 1873.80 USDT and select "Post Only," the order won’t be instantly executed but will be successfully added to the order book. However, if you set the buy price at 1874.20 USDT and it immediately matches the best ask price, the order will be canceled.

5.TP/SL Order

A TP/SL (Take Profit/Stop Loss) order is a closing order enabling traders to establish predefined trigger conditions for both take-profit and stop-loss prices, along with order prices. These orders are further categorized into one-way TP/SL and hedge TP/SL.

(1) One-way TP/SL

One-way TP/SL is a trading strategy where traders set a take-profit or stop-loss price in a single direction. With one-way TP/SL, once the market price reaches the predetermined trigger price, the system will automatically execute the order at the preset order price (either take-profit or stop-loss) and specified amount. This strategy enables traders to implement a one-directional approach to take profit or limit losses.

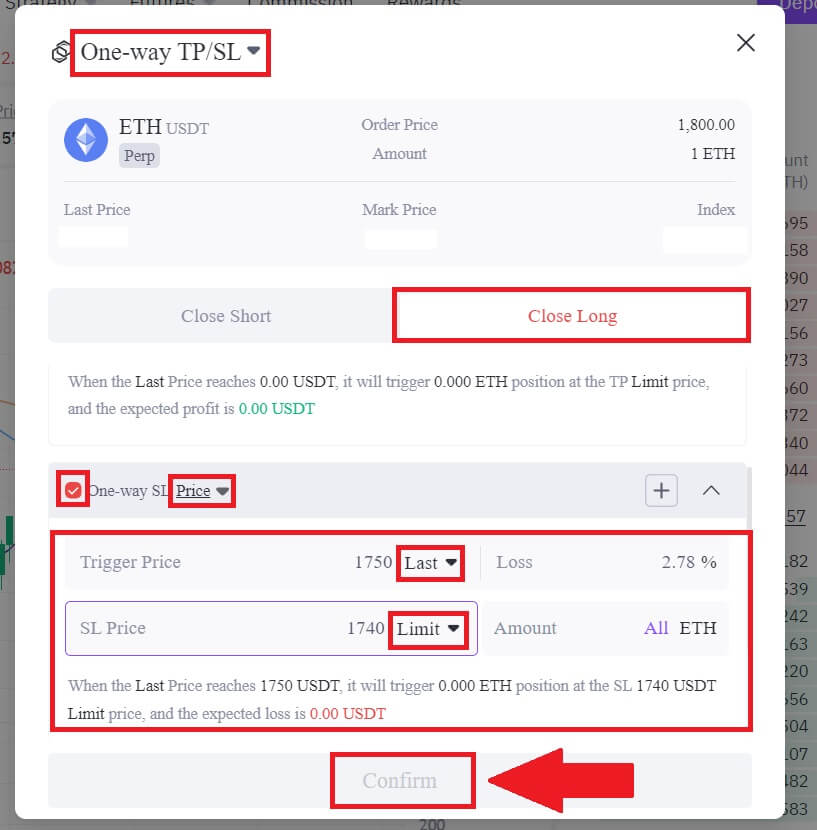

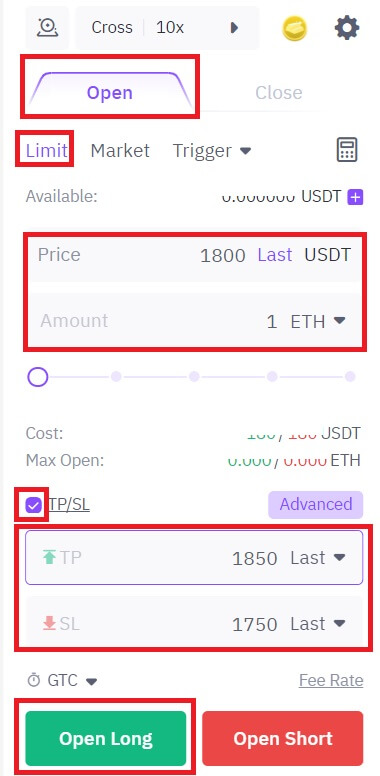

For instance, if you’re trading in the ETHUSDT perpetual futures zone under hedge mode, and the latest price of ETH is 1900 USDT, and you aim to open a long position of 1 ETH when the market price falls to around 1800 USDT, and intend to place an SL (Stop Loss) order to close the position when the market price falls to near 1750 USDT, you would place a limit order to open a position and establish a one-way SL order.

Select [Limit] on the trading page and enter the order price and order amount into the [Price] and [Amount] input boxes respectively. In addition, select [TP/SL], enter the SL price in the SL input box, and click [Open Long].

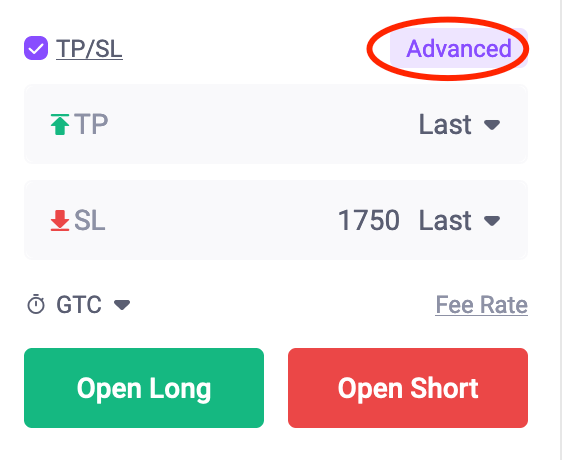

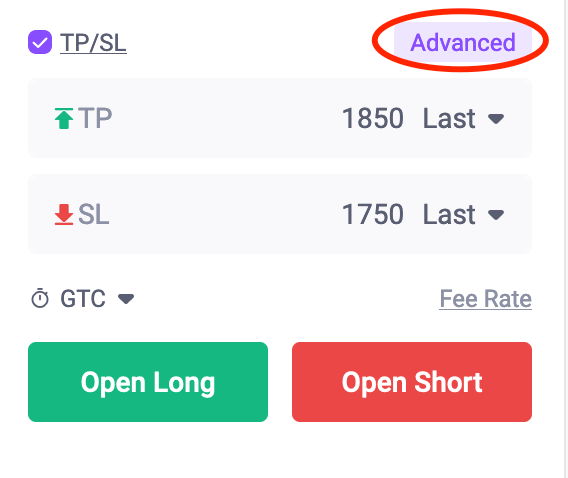

You can also click [Advanced] to set up more detailed parameters for a TP or SL order.

In the pop-up box, select [One-way TP/SL] and enter the desired TP or SL values, then click [Confirm].

(2) Hedge TP/SL

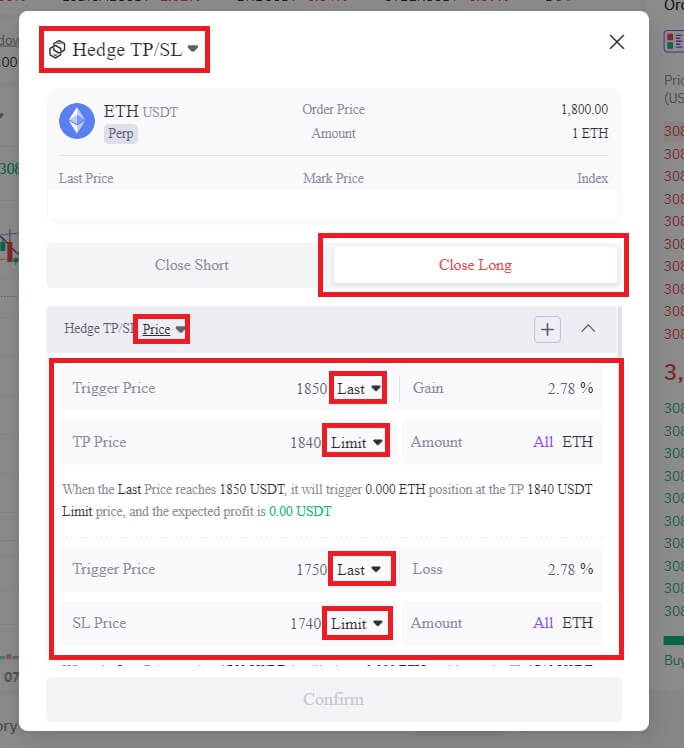

Hedge TP/SL is a trading strategy designed for both long and short positions, where traders set both take-profit and stop-loss orders simultaneously. When the trigger price is reached in one direction, the order in the opposite direction is promptly canceled. With Hedge TP/SL, upon the market price hitting the predetermined trigger price in any direction, the system automatically executes the order at the preset order price and specified amount in that direction, while simultaneously canceling the order in the opposite direction. This strategy facilitates hedging against both upward and downward movements, enabling profit-taking or stop-loss measures accordingly.

For instance, if you’re trading in the ETHUSDT perpetual futures zone under hedge mode, and the latest price of ETH is 1900 USDT, and you aim to open a long position of 1 ETH when the market price falls to around 1800 USDT. Additionally, you intend to close the position by placing an SL (Stop Loss) order around 1750 USDT or a TP (Take Profit) order when the market price surges to 1850 USDT, you can place a limit order to open a position and place a hedge TP/SL order.

Select [Limit] on the trading page and enter the order price and order amount into the [Price] and [Amount] input boxes respectively. In addition, select [TP/SL], enter the SL price in the SL input box, and click [Open Long].

You can also click [Advanced] to set up more detailed parameters for a TP or SL order.

In the pop-up box, select [Hedge TP/SL] and enter the desired TP or SL values, then click [Confirm].

It’s crucial to understand that while one-way and hedge TP/SL orders provide trading strategies for take-profit and stop-loss, they do not guarantee trade execution. Therefore, caution should be exercised when employing these strategies.

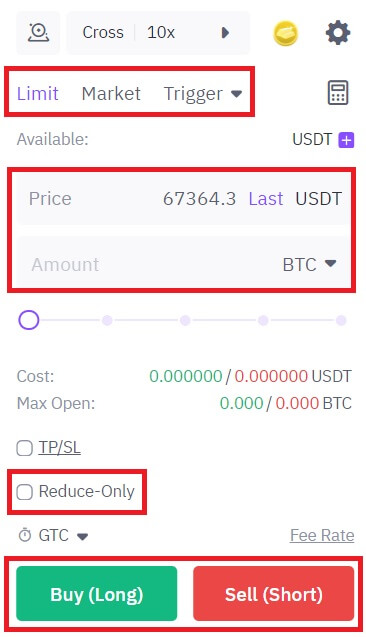

6. Reduce-Only

"Reduce-Only" is a trading option that exclusively allows users to decrease their existing positions without the ability to increase them. This option is solely available in the one-way mode.

Using the reduce-only feature in the one-way mode:

1. Reduce-Only" is unavailable if there are no positions held.

2. If you hold existing positions, you can use the "Reduce-Only" feature when placing an order in the opposite direction.

If the order size exceeds your existing position, the system will close the position according to its actual size. Any remaining orders will be automatically canceled, resulting in a ’Partially Filled’ status for the order. For instance, if you hold a short position of 0.2 BTC and place a ’Reduce-Only’ buy order for 0.3 BTC, the system will close the short position of 0.2 BTC and cancel the surplus buy orders.

If the order size is less than your existing position, the system will close the position proportionally to the order amount. This allows you to retain the remaining portion of your position. For example, if you hold a short position of 0.2 BTC and place a ’Reduce-Only’ buy order for 0.15 BTC, the system will close 0.15 BTC of the short position, leaving you with a remaining short position of 0.05 BTC."

3. When holding positions and utilizing the "Reduce-Only" option to place orders in the opposite direction, various outcomes may occur depending on market fluctuations:

-

Exceeding Position Size: If the order amount exceeds your current position size, the system closes the position based on its actual size. Any remaining orders are then canceled, resulting in a "Partially Filled" status for the order. For instance, let’s say you sell 0.2 BTC in USDT perpetual futures at 10:00, establishing a short position of 0.2 BTC. Later, at 10:20, you attempt to buy 0.5 BTC using "Reduce-Only" at a limit price, but the order is not immediately filled. By 10:30, you place a sell order for 0.1 BTC at market price, leaving you with a short position of 0.3 BTC. If at 10:50 the market price hits the limit price of the buy order for 0.5 BTC, the system automatically closes the short position of 0.3 BTC and cancels the surplus buy orders, refraining from opening a position in the opposite direction.

-

Less Than Position Size: Conversely, if the reverse order amount is less than your position size, the system closes the position proportionally to the order amount, allowing you to retain the remaining positions. For example, if you sell 0.2 BTC and establish a short position of 0.2 BTC, then attempt to buy 0.5 BTC using "Reduce-Only", and later sell 0.4 BTC at market price, resulting in a short position of 0.6 BTC. If at 10:50 the market price hits the limit price of the buy order for 0.5 BTC, the system automatically closes 0.5 BTC of the short position, leaving you with a short position of 0.1 BTC.

7. Time in Force (TIF) Order

FameEX’s perpetual futures trading offers three TIF types: Good Till Cancel (GTC), Immediate Or Cancel (IOC), and Fill Or Kill (FOK).

(1) GTC: A GTC order remains active in the market indefinitely until manually canceled or executed. Unlike other order types with specific durations, a GTC order can persist for days, weeks, or months.

(2) IOC: An IOC order aims for immediate execution, with any unfilled portion instantly canceled. If an IOC order isn’t filled completely upon placement, the remaining quantity is canceled immediately.

(3) FOK: A FOK order necessitates immediate and full execution. If a FOK order cannot be entirely filled, the entire order is canceled instantly.

For instance, when trading in the ETHUSDT perpetual futures zone under hedge mode, the current order book data will be presented as follows:

(1) If you opt for the GTC (Good Till Cancel) option when placing an order, and considering the latest price is 1873.89 USDT, opening a long position at a price of 1800 USDT, the order will persist in the market until it’s executed, manually canceled, or system canceled.

(2) Choosing the IOC (Immediate Or Cancel) option for a buy order at a price of 1874.10 USDT with a quantity of 2 ETH, if only 1.55 ETH are available for sale meeting the trading conditions, the order will be filled for 1.55 ETH, while the remaining 0.45 ETH will be immediately canceled.

(3) Opting for the FOK (Fill Or Kill) option for a buy order at a price of 1874.10 USDT with a quantity of 2 ETH, if only 1.55 ETH are available for sale meeting the trading conditions, the order will be canceled as it cannot be fully filled. However, if a buy price of 1874.10 USDT with a quantity of 1.5 ETH is set, the order will be completely filled.

FameEX Future Trading Modes

Position Mode

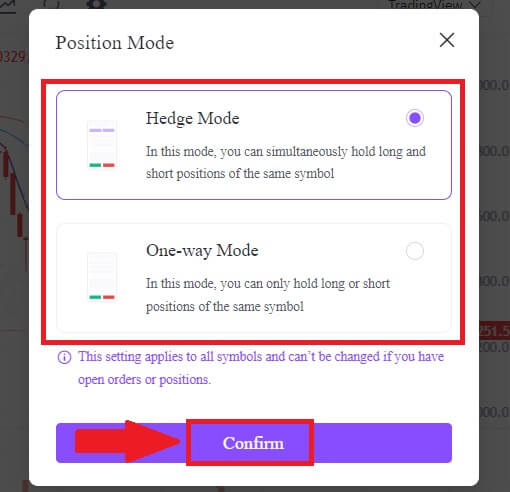

Position mode dictates how a position is maintained post-order execution, defining the conditions for opening or closing positions when placing orders. Typically, two modes are observed: one-way mode and hedge mode.

(1) One-way Mode:In one-way mode, you can only maintain either long or short positions of the same symbol, with profits and losses offsetting each other. Here, you can opt for a "Reduce-Only" order type, allowing solely the reduction of existing position holdings and preventing the initiation of positions in the opposite direction.

For instance, in trading USDT perpetual futures in one-way mode: Upon placing a sell order of 0.2 BTC and its full execution, a short position of 0.2 BTC is held. Subsequently buying 0.3 BTC:

-

Without selecting "Reduce-Only" for the buy order, the system will close the short position of 0.2 BTC and open a long position of 0.1 BTC in the opposite direction. Thus, you’ll hold a single long position of 0.1 BTC.

-

Conversely, selecting "Reduce-Only" for the buy order will solely close the short position of 0.2 BTC without initiating a position in the opposite direction.

(2) Hedge Mode:

Hedge mode enables the simultaneous holding of long and short positions of the same symbol, where profits and losses are not mutually offsetting. Here, you can hedge position risks in differing directions within the same symbol.

For example, in trading USDC perpetual futures using hedge mode: Upon selling 0.2 BTC and its complete fulfillment, a short position of 0.2 BTC is held. Subsequently placing an open order to buy 0.3 BTC results in holding a short position of 0.2 BTC and a long position of 0.3 BTC.

Notes:

- This setting applies universally to all symbols and remains unchangeable if open orders or positions exist.

- "Reduce-Only" is exclusively available in one-way mode. If no positions are held in one-way mode, this option cannot be utilized.

Steps to Switch Different Position Modes

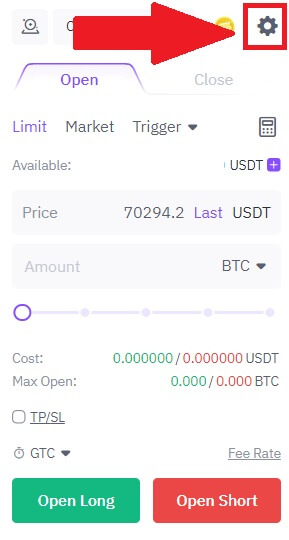

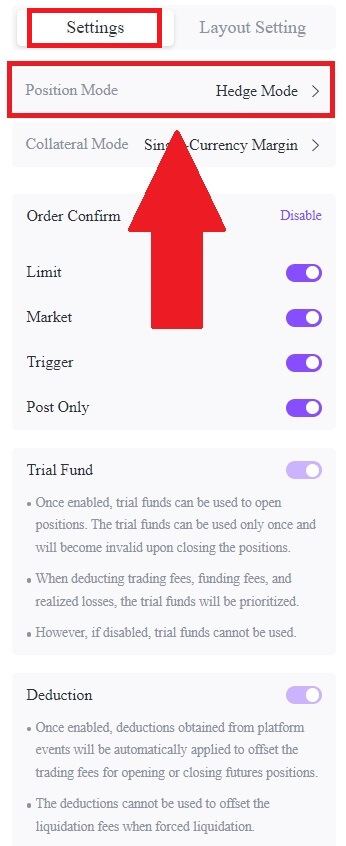

1. Click the [Settings] icon on the future trading page.

2. Select [Settings] and click [Position Mode] to choose a position mode.

3. Select [One-way Mode] or [Hedge Mode] and click [Confirm].

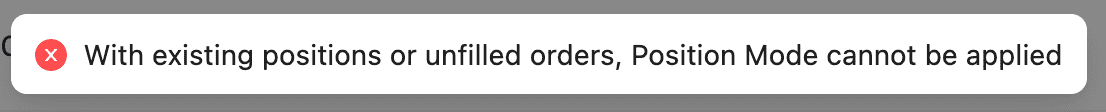

Note: If you have existing positions or open orders, a message of “With existing positions or unfilled orders, Position Mode cannot be applied” will pop up.

Margin Modes

(1) Isolated Margin Mode

-

In Isolated Margin Mode, the potential loss of a position is limited to the initial margin and any additional position margin used specifically for that isolated position. In the event of liquidation, the user will only incur losses equivalent to the margin associated with the isolated position. The available balance of the account remains untouched and is not utilized as additional margin. Isolating the margin used in a position allows users to restrict losses to the initial margin amount, which can be beneficial in cases where a short-term speculative trading strategy doesn’t pan out.

-

Users can manually inject additional margin into isolated positions to optimize the liquidation price.

(2) Cross-Margin Mode

- Cross Margin Mode involves using the entire available balance of the account as margin to secure all cross positions and prevent liquidation. In this margin mode, if the net asset value falls short of meeting the maintenance margin requirement, liquidation will be triggered. If a cross position undergoes liquidation, the user will lose all assets in the account except for the margin associated with other isolated positions.

Modifying Leverage

- Hedge mode allows users to employ different leverage multipliers for positions in the long and short directions.

- Leverage multipliers can be adjusted within the permitted range of the futures leverage multiplier.

- Hedge mode also permits the switching of margin modes, such as transitioning from isolated mode to cross-margin mode.

Note: If a user has a position in cross-margin mode, it cannot be switched to isolated-margin mode.

Frequently Asked Questions (FAQ)

How Do Perpetual Futures Contracts Work?

Let’s take a hypothetical example to understand how perpetual futures work. Assume that a trader has some BTC. When they purchase the contract, they either want this sum to increase in line with the price of BTC/USDT or move in the opposite direction when they sell the contract. Considering that each contract is worth $1, if they purchase one contract at the price of $50.50, they must pay $1 in BTC. Instead, if they sell the contract, they get $1’s worth of BTC at the price they sold it for (it still applies if they sell before they acquire).

It is important to note that the trader is purchasing contracts, not BTC or dollars. So, why should you trade crypto perpetual futures? And how can it be certain that the contract’s price will follow the BTC/USDT price?

The answer is via a funding mechanism. Users with long positions are paid the funding rate (compensated by users with short positions) when the contract price is lower than the price of BTC, giving them an incentive to purchase contracts, causing the contract price to rise and realign with the price of BTC/USDT. Similarly, users with short positions can purchase contracts to close their positions, which will likely cause the price of the contract to increase to match the price of BTC.

In contrast to this situation, the opposite occurs when the price of the contract is higher than the price of BTC - i.e., users with long positions pay users with short positions, encouraging sellers to sell the contract, which drives its price closer to the price of BTC. The difference between the contract price and the price of BTC determines how much funding rate one will receive or pay.

What Are The Differences Between Perpetual Futures Contracts and Margin Trading?

Perpetual futures contracts and margin trading are both ways for traders to increase their exposure to the cryptocurrency markets, but there are some key differences between the two.

- Timeframe: Perpetual futures contracts do not have an expiration date, while margin trading is typically done over a shorter timeframe, with traders borrowing funds to open a position for a specific period of time.

- Settlement: Perpetual futures contracts settle based on the index price of the underlying cryptocurrency, while margin trading settles based on the price of the cryptocurrency at the time the position is closed.

- Leverage: Both perpetual futures contracts and margin trading allow traders to use leverage to increase their exposure to the markets. However, perpetual futures contracts typically offer higher levels of leverage than margin trading, which can increase both potential profits and potential losses.

- Fees: Perpetual futures contracts typically have a funding fee that is paid by traders who hold their positions open for an extended period of time. Margin trading, on the other hand, typically involves paying interest on the borrowed funds.

- Collateral: Perpetual futures contracts require traders to deposit a certain amount of cryptocurrency as collateral to open a position, while margin trading requires traders to deposit funds as collateral.

Trading Fee Calculations of USDⓈ-M Perpetual Futures

Trading FeesTrading fees on the FameEX platform are determined by the fee rate level applicable to futures trading. These fees are only incurred upon completion of an order and are not charged if the order remains unexecuted.

Futures Trading Fees

1. Go to the FameEX Website, scroll down to the bottom and click on [Fees].

2. On this page, you can view the Futures fee rate and the corresponding trading fee rate.

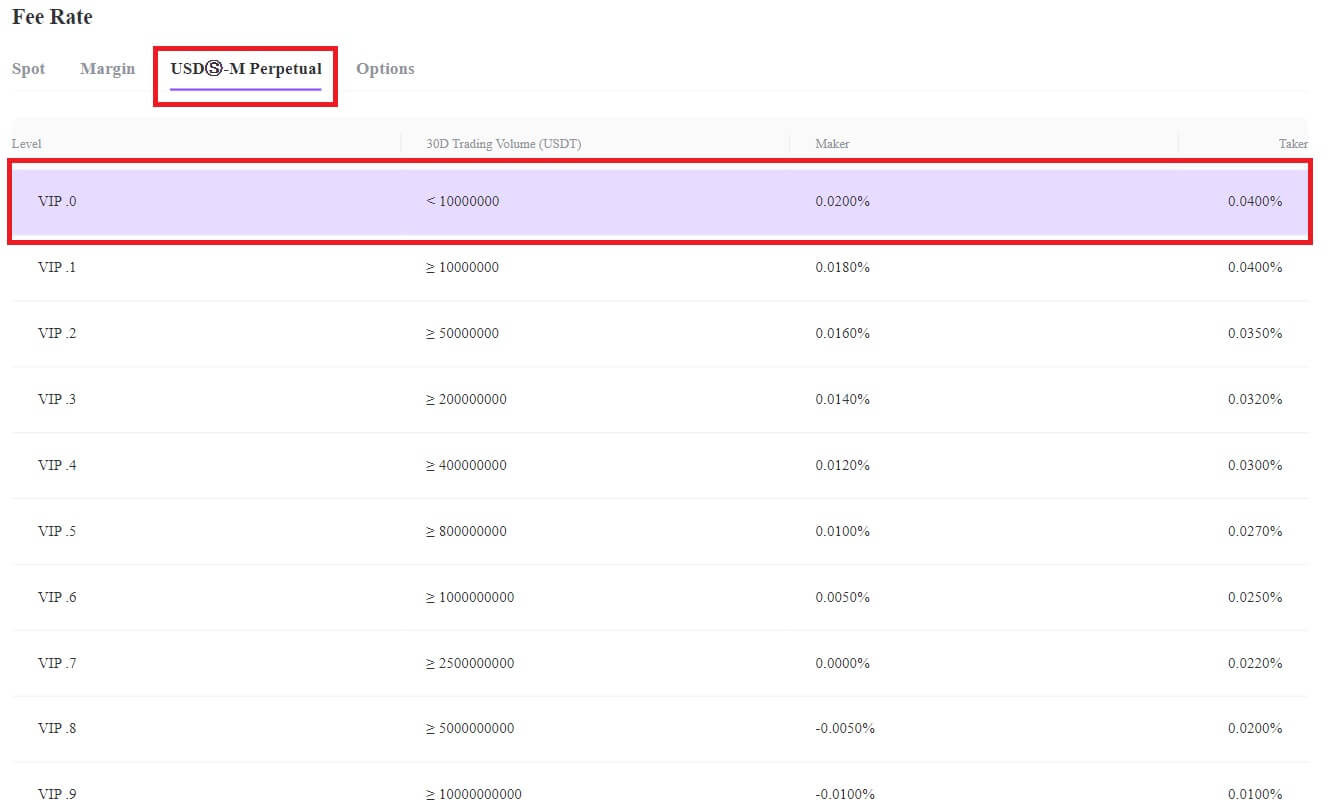

Rules:

- Futures trading fee rates range from VIP.0 to VIP.9, with higher trading volumes corresponding to lower fee rates and higher levels.

- The fee rate level depends on the user’s accumulated trading volume over the past 30 days in USDT. For instance, if a user’s trading volume is less than 10,000,000 USDT, their fee level is VIP.0, with a Maker fee of 0.02% and Taker fee of 0.04%. If the trading volume is between 10,000,000 USDT and 50,000,000 USDT, the user’s fee level becomes VIP.1, and so forth.

- Fee rate levels are automatically updated daily at 00:00 (UTC+8) based on accumulated trading volume over the past 30 days. After the update, the platform charges trading fees according to the new level’s preferential rate.

Fee Calculation:

Futures Trading Fee = Quantity * Price * Fee Rate

For example, in hedge-way position mode, a regular user (fee rate level: VIP.0) opens a Long BTCUSDT position with 0.5 BTC at a market price of 28,000 USDT as a Taker. Then, the user closes this Long position at a limit price of 29,000 USDT, with a quantity of 0.5 BTC.

[Regular User’s Fee Rate: Maker: 0.02%; Taker: 0.04%]

Opening Fee: 0.5 * 28000 * 0.04% = 5.6 USDT

Closing Fee: 0.5 * 28000 * 0.02% = 2.8 USDT

Notes:

Maker: A maker is a user whose order is not immediately matched with existing orders in the market but is added to the order book, waiting for other users to match with it.

Taker: A taker is a user whose order immediately matches with existing orders in the order book.

The trading fee depends on the user’s actual transaction position value and fee rate level. Higher fee rate levels correspond to lower trading fees.

Common Reasons for Failed Orders in Futures Trading

When trading in USDⓈ-M perpetual futures, you may fail to place an order or experience unfilled orders due to multiple factors. The following are possible reasons:

Reasons for Order Failure:

-

Insufficient margin: Other open orders are currently utilizing the same margin.

-

Order trigger failure: Insufficient margin or position size to close when a trigger or TP/SL order is triggered.

-

Position size limit: The position size exceeds the limit supported by the current leverage.

-

Amount limit: The order amount falls below the minimum threshold or exceeds the maximum limit.

-

Price limit: The order price is either too low (below the minimum order price) or too high (exceeds the maximum order price).

-

Quantity limit for unfilled orders: The maximum number of unfilled orders for all symbols is limited to 50. Exceeding this limit prevents further order placement.

-

Post Only order filled immediately: A Post Only order is canceled if filled immediately.

-

FOK order cannot be immediately and fully filled: If a FOK order cannot be immediately filled in its entirety, it is canceled.

-

IOC order cannot be immediately filled: If an IOC order is not immediately filled in its entirety, the unfulfilled part is canceled immediately.

-

In One-way Mode with no positions, the "Reduce-Only" option cannot be selected to place an order.

Reasons for Unfilled Order Failure:

-

Significant deviation from market price: The order price does not match any orders in the market depth pool. Additionally, when the position size is too large, market price fluctuations during partial execution result in price deviation, impeding the execution of remaining positions.

-

Price not match: When placing a trigger or TP/SL order, if the market price reaches the trigger price, the system places the order at the specified price. Orders are matched based on price priority and then time priority. If there are no matching counterparty orders, the order cannot be executed.